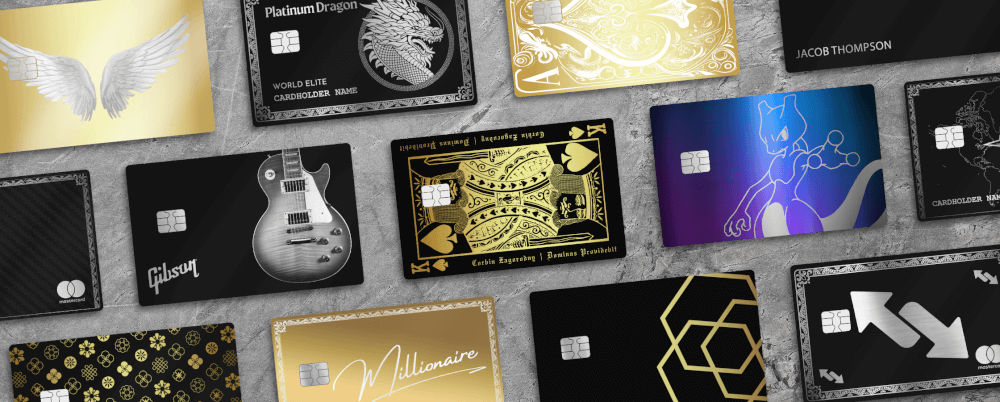

Best Metal Credit Cards 2025

Alright folks, gather 'round, grab your lukewarm latte, and let's talk about something that's been lighting up my inbox like a dumpster fire in a fireworks factory: metal credit cards. Yeah, I know. You’re probably picturing yourself dramatically slamming one down on a bar, the clink echoing like a tiny, expensive rebellion. Well, buckle up, buttercups, because we're diving headfirst into the glittering, sometimes baffling, world of the best metal credit cards of 2025.

Now, before you start envisioning yourself as some kind of high-stakes James Bond character, remember that the only secret mission you’ll be on is figuring out which of these weighty plastic (or rather, metal) imposters will actually benefit your humble existence. It’s not just about looking cool; though, let's be honest, that’s a pretty big chunk of the appeal. It’s about the perks, the prestige, and the sheer, unadulterated joy of owning something that feels like it was forged in the fires of Mount Doom.

First off, why metal? Is it because our regular plastic cards are too… flimsy? Did they offend a guild of ancient blacksmiths? The truth is, it's a mix of status symbol and a way for issuers to make their cards stand out in a sea of boring beige rectangles. Think of it as giving your wallet a tiny, very expensive makeover. Plus, it’s surprisingly satisfying to tap a piece of metal that cost more than your last pair of socks.

The Contenders: Who's Shinier Than a Newly Polished Knight's Armor?

So, who are the big players in this metallic arms race for 2025? We’ve got some returning champions and some surprising new contenders. Let’s not waste time with a drumroll; we’ve got credit to earn!

The OG: The Chase Sapphire Reserve

Ah, the Chase Sapphire Reserve. This card is like the seasoned rockstar of the metal card world. It’s been around, it’s seen it all, and it’s still delivering the goods. For 2025, it’s still rocking its iconic brushed metal finish, and honestly, it’s still a beast for travel rewards. Think hefty points multipliers on dining and travel, a surprisingly decent annual travel credit that almost makes you forget the hefty annual fee (almost!), and access to those fancy airport lounges where you can sip overpriced champagne and judge other people’s carry-on luggage.

The downside? That annual fee. It's not pocket change, folks. It’s more like "buy-a-small-country's-economy" change. But if you’re a frequent flyer or a dedicated foodie who likes their foie gras with a side of bragging rights, it might just be worth it. Just don’t be surprised if your wallet suddenly develops a gravitational pull towards your bank account.

The New Kid on the Block (ish): The American Express Platinum Card

Now, the American Express Platinum Card is less of a "new kid" and more of a "very established, slightly aloof celebrity" who decided to grace us with their metallic presence. This card is all about that luxury lifestyle. Airport lounge access? Check. Hotel elite status? Check. Statement credits for everything from Uber to Saks Fifth Avenue? Double-check. It’s basically a VIP pass to the good life, wrapped in sleek, cool metal.

But here’s the kicker: the annual fee. It’s a doozy. It’s so high, it makes the Sapphire Reserve’s fee look like a polite suggestion. However, the sheer volume of credits and perks can, in theory, offset that cost. It’s like playing a very complicated game of financial Tetris, where you have to strategically use every single benefit to avoid losing your shirt. And let's not forget the satisfaction of having a card so heavy, it could probably double as a self-defense weapon. Just saying.

The Dark Horse: The Capital One Venture X Rewards Credit Card

Now, for those of you who want the metal bling without needing to sell a kidney, let’s talk about the Capital One Venture X Rewards Credit Card. This one’s been making waves, and for 2025, it’s still holding its own. It offers a solid travel rewards program with a decent welcome bonus, and it’s got that satisfying metal heft. Plus, it comes with airport lounge access and some pretty sweet travel perks that don’t require a degree in advanced accounting to understand.

The annual fee here is a lot more manageable than its more flashy competitors. It’s more of a "splurge on a nice dinner" fee rather than a "buy a small island" fee. This makes it a fantastic option for people who want the metal card experience without all the intense budgeting required for the ultra-premium cards. It’s the sensible supercar of the metal card world – still impressive, but won’t bankrupt you on the first pit stop.

Beyond the Shine: What Else Matters?

Look, as much as we love the idea of a credit card that feels like it was mined from a meteor, it’s not just about the metal, people! We gotta talk about the rewards, the fees, and the actual benefits. Because let’s face it, the best metal card is the one that actually helps you, not just the one that looks prettiest in your Instagram story.

Rewards programs are king here. Are you a travel hawk? A cashback connoisseur? A points-hoarding dragon? Make sure the card you choose aligns with your spending habits. A card that gives you 5x points on obscure artisanal cheese might be cool, but not if you only buy cheese once a year.

And then there are the annual fees. These can range from "ouch, that stings a bit" to "my eyes are watering so much I can barely see this card." Do your homework! Seriously, do the math. Can you actually use the benefits to offset that fee? If the answer is "maybe, if I sell my soul and promise to travel to a different continent every month," then maybe reconsider. Unless, of course, you have a lucrative side hustle as a professional credit card influencer.

Don't forget the other perks! Things like travel insurance, purchase protection, and concierge services can be surprisingly useful. The Amex Platinum’s concierge, for example, is rumored to be able to book you a table at that impossible-to-get-into restaurant or even find you that rare vintage vinyl you’ve been searching for. It’s like having a tiny, very polite genie in your wallet, but with better fashion sense.

The Verdict (For Now):

So, what’s the takeaway from this metallic extravaganza? The best metal credit cards of 2025 are still a blend of aspiration and practical benefit. The Chase Sapphire Reserve remains a top-tier travel card, the Amex Platinum is the king of luxury perks (with a fittingly regal price tag), and the Capital One Venture X offers a more accessible entry into the metal card club.

Ultimately, the "best" card is the one that fits your life. Don’t get swayed by the shine alone. Think about where you spend your money, where you want to go, and how much you’re willing to invest. And hey, if all else fails, at least you’ll have a very impressive coaster.

Now, if you’ll excuse me, I need to go practice my dramatic card slam. For research purposes, of course.